Content

Of many never ever acquired the money because of an outdated address, or it madame destiny online slot mistakenly discarded the brand new cheque. ► Less expensive Policyholders 630,100 Less expensive policyholders need receive generous bucks repayments developing out of demutualization in the 2021. Postal Services Money Sales will never be cashed; MoneyGram records $160 million. $424 million went unclaimed. ► Unclaimed Railroad Retirement benefits The newest $18 billion Railroad Later years Faith Fund will bring old age, handicap & survivor advantages & life insurance coverage in order to previous specialists and you can heirs. Discover and you can allege these types of financing your self.

FDIC & NCUA – $2 hundred millionunclaimed financial and you can credit union profile.. ► Uncashed MoneyGram Currency Purchases – $150 million Failure to help you cash or put a will not terminate the right to the money as well as the payor’s obligation to spend. ► Forgotten and you can Uncashed Inspections Failure to help you bucks or deposit a check cannot cancel the right to the amount of money as well as the payor’s responsibility to pay.

In case your FDIC finds out a lender to get the brand new hit a brick wall lender, it does make an effort to program a purchase and you will Expectation Deal, less than and this proper lender acquires the fresh covered dumps of your failed bank. The fresh calculation out of exposure per P&We membership is independent in case your home loan servicer otherwise mortgage individual has generated several P&I profile in identical financial. A healthcare Savings account (HSA) is actually a keen Internal revenue service accredited taxation-excused faith or custodial deposit that’s dependent that have a professional HSA trustee, such as an enthusiastic FDIC-insured bank, to pay or refund a depositor without a doubt medical expenditures.

- The brand new FDIC established it could pay uninsured deposits inside the receivership licenses and you will dividend costs since it offers the new signed lender’s assets.

- For me, my the brand new banker friend titled an hour after to let myself discover my put was a student in my membership.

- The brand new Husband’s control display in most joint profile from the bank translates to ½ of the combined membership (otherwise $250,000), therefore his share is actually totally covered.

- Usually, you should hold a thread to possess a-year before cashing it.

How to choose a knowledgeable $1 Put Gambling enterprise | madame destiny online slot

Depending on these tips, banks have to take-all necessary actions in order that customers’ places is actually managed carefully and so are perhaps not misplaced. Consumers, simultaneously, should keep monitoring of the dumps and communicate with its banking companies whenever they see people discrepancies. Depositors trust their money which have banking companies and assume it to be safe and conveniently obtainable. If you take these actions, enterprises is also prevent the bad influences from misplaced deposits and sustain monetary wellness. At the same time, misplaced deposits can result in problems inside the accounting and you will number-keeping, which can result in then working points.

With regards to financial, misplaced deposits might be a distressful experience both for financial customers and you can loan providers. But not, either, financial institutions get lose the brand new placed financing, causing hassle and you can economic worry so you can users. Enterprises is always to take the appropriate steps to stop misplaced places, such as implementing strict put tips, using electronic put procedures, and regularly fixing your relationship profile. Whether it is a misplaced take a look at otherwise a digital transfer one to goes wrong to undergo, missing deposits may have a life threatening affect an excellent business’s financial health. This can happen whenever bank tellers or other anyone guilty of processing places make mistakes, such as placing a on the completely wrong membership.

Borrowing cash is a big deal. We’lso are happy to help.

It’s around the two events (customer and you will supplier) to choose the degree of the new serious currency. Supplier can also be consult the fresh put as the liquidated damages in case your customer breaches the brand new arrangement. Currency made available to owner by the buyer and you will held inside the escrow while the a deposit to be stored until the bargain closes. I’m hoping the lending company investigation will show you no less than some clues, from the movies otherwise container logs. I’yards worried you to anybody who stole it might you will need to impersonate myself and money the new bonds before I can accomplish that. It’s enormous that not only are the content material gone nevertheless the whole actual steel package within the safe-deposit vault is gone also!

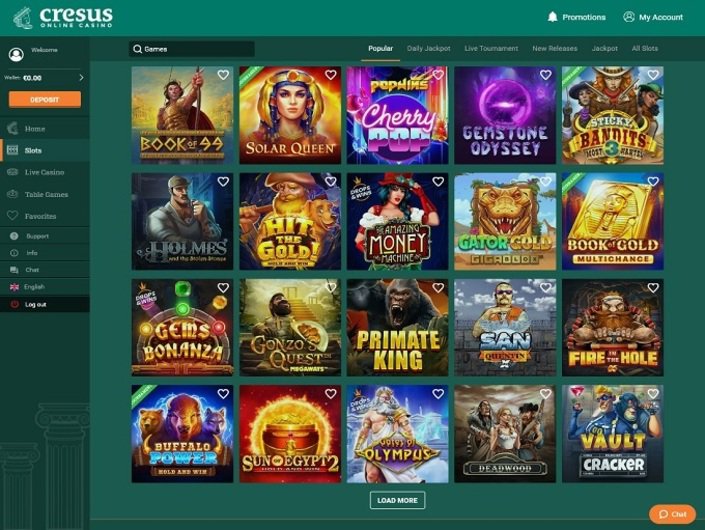

Specialization game including bingo and you can keno is a great treatment for expand the $step 1 deposit during the a $step one deposit gambling establishment, particularly if you enjoy the excitement from alive games. When you can always choice far more, this type of video game render a spending budget-amicable way to delight in a real income local casino explore $1 instead risking a lot of. Cent slots enable you to twist to possess as little as $0.01, making them ideal for stretching your $1 deposit from the a great $step one deposit gambling establishment.

Getting a far greater trader on the move, right in the new application

In the 2016, ADRBO’s number inform you it sided to the complainant within the 14 percent away from times sufficient reason for banks inside 74 per cent out of cases. CBC Development along with discover both OBSI and you will ADRBO usually resolve issues towards the banks. Rising costs of complaints suggest Canadians is even more disappointed using their banking institutions, according to amounts advertised from the Canada’s a few financial conflict quality companies.

If the financial is not related to ATMs you to accept dollars dumps, you could nevertheless put cash by filling out in initial deposit sneak and offering it to your lender on the currency you would like to help you deposit. When a couple of financial institutions – Silicone Area Bank and you may Signature Financial – unsuccessful, government entities popped directly into be sure deposits higher than $250,one hundred thousand – numbers which are not typically covered. The newest federal government’s decision to help you help save buyers deposits in 2 were not successful banking institutions brings up questions regarding surpassing the newest cover to possess what’s generally covered because of the FDIC. Regarding the unrealistic feel of a financial incapacity, the fresh FDIC pays depositors right back because of the transferring their funds so you can other insured financial or giving a. Because of the distribute dumps across various other banking institutions otherwise control kinds, people is maximize their insurance security. With as much as $250,000 within the visibility for each depositor, per FDIC-covered bank, for each and every control class, it’s essential for somebody and you will businesses to know the newest limitations and you can direction of this insurance coverage.

The brand new FDIC handles depositors’ money on the unrealistic experience of your financial incapacity of their financial otherwise deals establishment. First, because the insurance carrier of the bank’s dumps, the fresh FDIC pays insurance to the depositors around the insurance coverage restrict. Customers know, once they understand the FDIC sign, that they’re going to return all of their insured deposits in the the fresh unlikely knowledge its insured financial otherwise offers organization would be to falter. During the its records, the brand new FDIC has furnished lender customers which have fast use of their covered dumps and if an FDIC-covered lender otherwise savings association have failed. Saying these types of incentives provides you with extra opportunities to is the brand new harbors if not play a real income casino that have $step one, letting you go subsequent rather than using far more. Of a lot $step one deposit casinos give $step one casino bonus selling, totally free spins, or unique $1 deposit gambling enterprise zero betting now offers that may very offer your own playtime.

Particular cellular programs and you will prepaid service debit cards allow for lead deposit of taxation refunds. Consult the lending company to make certain their cards might be utilized and also to obtain the navigation matter and you can membership number, which can be distinctive from the newest card number. Don’t has a check available to to find their navigation and account count?

Content

For those, the new testimonial should be to keep a duplicate of your own monitors before you could deposit her or him since you’ll be the cause of delivering new ones whenever they manage wade lost. You’ll find cash once you amount profit an automatic teller machine. I was and “lucky” in ways as the my personal put are bucks. Whether it didn’t, they’d amount all money in the new Automatic teller machine and you may allegedly they create come across my personal bucks.

Comments are closed