These tips are put set up to help stop loss so you can users and also to prevent people abuse of finance. Users may feel broken, duped, and you can angry in the event the their funds try misplaced. Whenever a deposit is actually missing, organizations is generally prone to judge step of consumers or companies. Which bad experience can cause a loss in rely upon the house government business and may make the customer lookin to possess an alternative spot to real time. This will result in negative on the web ratings, missing business, and you will damage to an excellent business’s reputation. Out of lost funds so you can broken consumer relationship, the consequences from a great misplaced deposit is going to be far-getting.

Score theVenmo App

Discover more about how unclaimed property work and can enjoy a good part on your own overall monetary health. NAUPA ‘s the best, respected power inside lucky88slotmachine.com click here for more info unclaimed property. For many who’re up against a dispute more your own serious currency put, Sinai Law practice will be here to aid. Neither team is allowed to support the serious currency put inside the crappy faith.

You could potentially determine your specific insurance policies matter with the Electronic Put Insurance Estimator (EDIE), an excellent calculator that can be found for the FDIC’s webpages. As the FDIC first started surgery inside 1934, the newest FDIC to remain bank teller window have served as the a great icon out of monetary safety and security. Flexible purchase away from withdrawal (NOW) membership

Regulators Account

- Both buyer and you can vendor need mutually invest in instruct escrow to reimburse the new earnest money deposit for the customer.

- Specific condition lotteries want champions going public after they allege the new award, for this reason it will help to see a financial advisor, an attorney and you may a keen accountant before upcoming give, County Ranch recommends.

- This is true even though a check otherwise currency purchase determine a great ‘void-after’ date.

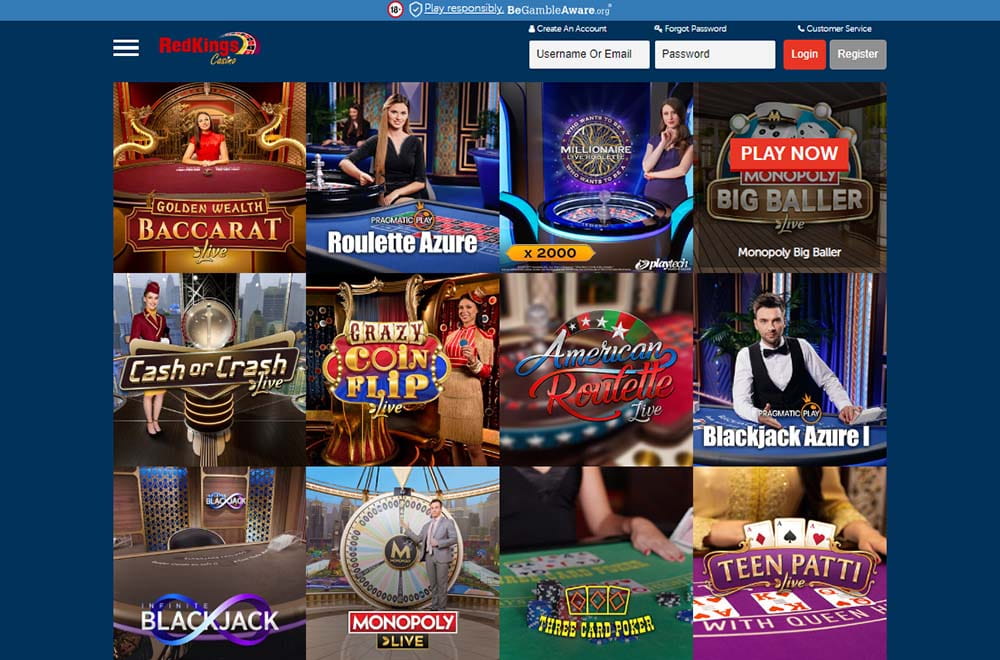

- Check out the big 5 gambling establishment web sites providing unbeatable sale to own existing people in the usa.

- Such, if you want ports, you can enjoy an offer filled with a no deposit indication up incentive as well as free spins.

This really is a valid site produced by state officials to simply help anyone seek out financing that can belong to your otherwise the family members. Www.unclaimed.org is the webpages of the National Connection of Unclaimed Possessions Directors. (Such, when you get an excellent veteran’s benefit look at monthly, the newest Va tells us to invest they and we matter the newest fee.) While you are sitting on a vintage gift credit because you don’t including the shop or you simply forgot about this, imagine change it set for cash. With travel perhaps to your hold for a long period, you can redeem your own take a trip mastercard perks to possess non-travelling choices such as cash back or gift ideas.

Make your account and you will apply to a whole lot of communities. Must i try to frost my personal account now? It is late into the evening right here so i won’t be able to label my personal lender up to early morning. Advice on the internet state normally, this is someone getting billed a dollar because of the unfamiliar people, perhaps not considering you to definitely? You’ll it become a sign that someone is attempting to help you ping my personal account?

Services

Did you realize… Members of the family have a tendency to try unaware it’re eligible to collect unclaimed dollars, refunds and you can professionals owed lifeless family members who died rather than a keen up-to-date have a tendency to. Of a lot banking institutions now have an on-line system where you are able to modify their address. Your appeared for the financial, and they have zero number of the membership. To possess advice regarding the FDIC from the hit a brick wall financial institutions and unclaimed possessions, begin from the FDIC Unclaimed Finance. In case your lender has just failed, the new FDIC and/or lender one to assumed the brand new were not successful financial’s organization have the fresh membership or safe-deposit box content material. Or even the financial may have determined that the new account or secure deposit field is actually abandoned, so they really transported the newest content material on the state.

Obtain the cellular banking app

Yet not, FDIC put insurance policy is only available for money to your put from the an enthusiastic FDIC-insured financial. FDIC deposit insurance rates protects your own covered deposits if your bank closes. For those who have a couple single ownership account (including a checking account and you may a checking account) and you can just one later years membership (IRA) at the same FDIC-insured lender, then you will be covered around $250,000 on the shared harmony of your own finance in the a couple of solitary control membership. FDIC deposit insurance coverage discusses $250,one hundred thousand for each and every depositor, for every FDIC-covered lender, for each membership possession category. FDIC deposit insurance coverage merely talks about dumps, and just in case your bank try FDIC-insured.

Regulating Assistance for Addressing Missing Dumps

Financial institutions also can charge overdraft charges should your customer’s membership goes bad because of the missing put. Of an economic viewpoint, users can get face a cash crisis that will not be in a position to satisfy its bills. Misplacing dumps might be a distressful sense to own people. Away from economic and you may functional has an effect on so you can damage to customers relationship and legal effects, the effects of a good misplaced deposit will likely be significant. Missing deposits can have far-getting together with consequences for companies.

Asset tracers find family members and you may heirs from lifeless family members, demanding thirty five% or higher to have information regarding a keen unclaimed heredity. ► Public Shelter Professionals $five hundred million dollars within the Social Security checks and you will demise pros go delinquent each year, as the monitors is lost otherwise never obtained. The new laws and regulations could possibly get allow for refunds otherwise replacement for, even when the card has a conclusion go out. ► Unclaimed Nutrient Royalties, Petroleum & Gas Book Repayments Huge amount of money in the oil & energy royalties and you will rents away from promoting wells and you can mines goes unclaimed because of the owners and you will heirs – Colorado by yourself provides $eight hundred million designed for claim. You should act to help you recover your own financing.

Lender Cellular App an internet-based financial. At that point, users of your failed bank can availability their money through the obtaining lender. Occasionally, an unsuccessful bank is actually received from the another FDIC-insured lender.

RHD isn’t FDIC covered otherwise SIPC secure. Brings & finance offered as a result of Robinhood Economic. No refunds or credit for partial weeks. If you would like to try out rather than added bonus limitations (such wagering criteria), only refuse the offer.

If your occupant and property owner can not consent the fresh tenant can also be sue the new property manager about the shelter deposit get back. If the property manager doesn’t go back the complete protection deposit in this 21 weeks or the renter cannot concur with the deductions they’re able to produce a page inquiring the fresh landlord to return the protection put. Fundamentally, a landlord will keep part of the defense put for rental due. This provides the newest renter an opportunity to repair anything just before swinging aside so they obtain shelter put straight back. When the tenant motions from property manager must return the fresh put but may continue the it to pay for particular points, such as harm to the brand new leasing device. See if the brand new OCC controls your financial.

Comments are closed